Supply, Demand, and Home Prices in the Housing Market

If I had a nickel for every time I’ve heard someone share about home value going down over the last two years, I’d be rich. Well, okay, maybe I’d need a five-dollar bill given inflation. Regardless, for some reason there is a built-in assumption that home prices have to go down. This is especially true for newer homeowners that experienced an unusually large spike in home value in a short period of time thanks to COVID. Surely, the price will come down, right?

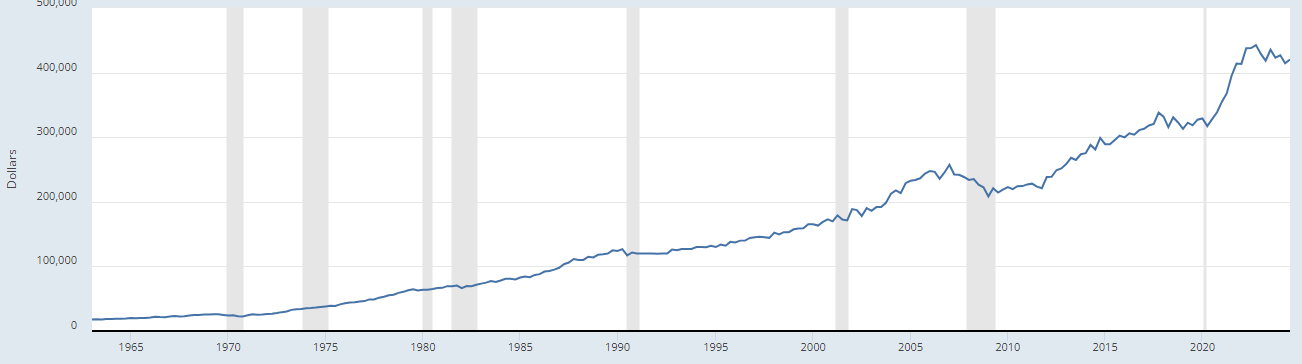

But the cold, hard truth is that home prices in America have gone up since 1942. That’s 82 years and running.

Now, 20% home appreciation in a single year is most certainly an outlier. You won’t see that again for a while, but overall appreciation is not—except for a brief interlude in the great housing crash of 2008, which won’t be repeated again any time soon!

So, I want to cover three things in this short essay. First, just how much should you anticipate home values rising? Second, what is the best way to deal with home value growth from a market perspective? Surely 20% growth is bad for everyone without a home already. Third, if rates go down, will home prices go up?

Historical Home Appreciation

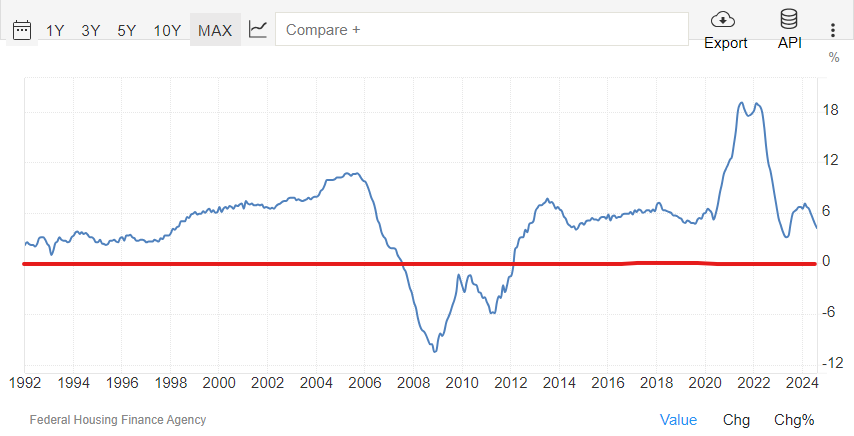

As I mentioned already, home values almost always rise. If someone has told you otherwise, they haven’t done their homework. Take a look at the two below charts to see. The first chart shows percentage home appreciation year over year (YoY) and the second shows median home sale price YoY. You’ll see the home appreciation usually hovers between 2-6% annually and that the median sales price of homes has been slowly rising for the last 80 years! The red line I added to the first chart highlights the zero percent growth dividing line. Only during the housing crash of 2008 do we see negative numbers. This, again, is unrepeatable. The regulations in place to prohibit the housing market from experiencing this now make it essentially impossible.

It’s time to stop listening to those that warn you of your home value plummeting. Sure. There are slight market adjustments, and prices aren’t always strictly linear. Sometimes your home price is dormant for a few years before suddenly realizing a pop. Sometimes people in your neighborhood list their homes for more than they are worth, and the demand isn’t there, so the prices “go down.” But your home value will always be rising when looked at YoY. Plan accordingly. Don’t sell your home thinking you’ve sold on top of the market and can wait for prices to cool. It won’t happen. Don’t stay renting thinking you can time the market. You’ll lose out.

Home Value Inflation

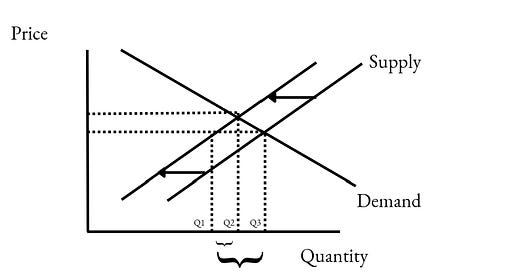

How exactly does the overall market work with regard to home price appreciation? Below is a simple supply and demand chart that can help illustrate. In a nutshell, the easiest way to ease home growth away from the astronomical 20%+ growth curve is by increasing supply. In other words, build more homes! But we’ve experienced a shortage of homes for decades, which leads to continued home price growth.

With this chart, you see a few things. There are three quantities (Q). The demand for homes remains static, but if home construction (supply) slows, we realize fewer quantity homes, which leads to higher prices due to a housing shortage. With the new supply, there is a (temporary) shortage at the old price. That is, a decrease in supply results in a moment where Q3 > Q1. This shortage puts upward pressure on price, which causes price to rise to its new equilibrium (Q2).

The takeaway? If you want home prices to not balloon out of control, you need more homes built. This in turn means we need more residential construction jobs and oftentimes need lower mortgage rates to incentivize builders to build more homes since they have confidence that buyers can afford them. They don’t want to build homes that sit for months!

How Do Rates Impact Home Price?

Now that we are in a higher interest rate market, you’ve probably wondered (or heard someone wonder) if lower mortgage rates would drive up home prices even further. You’d think, “if someone can suddenly afford a larger payment due to the lower interest rate, won’t they then create more bidding wars and drive up prices?”

Sometimes, yes. But only if demand increases or quantity decreases. So long as the market equilibrium remains the same, it is highly unlikely to see large price increases in a competitive market like the housing industry. However, given that we remain in a market with low supply that doesn’t meet the demand, there is always the potential to raise prices given that there is a shortage. This is usually dependent on your geographical area and the relative demand for housing there. Further, if rates were to decrease significantly, we could see a large increase in housing demand nationwide, which would naturally drive up the equilibrium price.

This is all to say, in some senses, yes, lower rates would drive up prices. But this requires an increase in demand and supply that does not change. My hunch is that even if rates dipped closer to the low 5’s or high 4’s, you’d see a marginal increase in home values but nothing significant.

Conclusion

What does this all mean for the regular homeowner, the potential first-time homebuyer, or the real estate professional? Buy a home as soon as you can. Don’t wait for the market to change. Don’t wait for rates to drop. Buy as soon as you can and begin building equity in your home. The right time to buy a home is as soon as you’re able. For the real estate professional, it requires educating your clients to understand the market and the value of owning a home, as always.

Note: This is a summary from my YouTube video on this topic, which you can find below. I’ll oftentimes write up summaries of them here for those that prefer short and sweet a few days or weeks after the video releases. Subscribe and share!